Business Digital Banking Support

Menu

Questions about Business digital banking?

Check out our tutorials and common questions to learn how to get the most out of your Business digital banking experience.

Sign in to digital banking

Digital Banking Tutorials for Business

Get the most out of our enhanced digital banking experience.

We’ve put together a series of hands-on tutorials to give you a tour of Coast Capital’s digital banking and show you how to use features that are important to your business.

To get started, select the device you plan to bank with.

Tutorials

Learn how to set up your new username, password and security code credentials on our Getting Started page.

Forgot your password? No problem. Follow these steps to reset it on the app or through Coast Online®.

-

From the login screen, click Forgot Password

-

Enter your username

-

Enter your email or phone number

-

Follow the instructions that are emailed or texted to you

Simplify your login experience by setting up your phone’s biometric login features (if applicable).

-

Follow your device’s instructions for turning Fingerprint ID or Touch ID on

-

Log in to the Coast Capital app

-

From the menu, click Security

-

Click Set up Fingerprint/Touch ID

This is an error happening on our end that we’re working to fix as soon as possible. If you were paying a bill, clear your cache and double check your accounts before trying again as the payment may have gone through.

Our functionality with some 3rd party aggregators has been temporarily impacted due to recent security enhancements. We are aware of these issues and are working with our partners to ensure that functionality is returned to normal

To help solve challenges you may experience with digital banking, we may ask you to access digital banking using a private browser (also known as Incognito). Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

- Open Chrome on your computer

- Click the More button “

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac)

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac) - Click “New Incognito Window”

- A new window will open for you to use

Safari (Mac)

- Open Safari on your computer

- Click “File”

- Click “New Private Window”

- A new window will open for you to use

Firefox

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “New Private Window”

- A new window will open for you to use

To help solve challenges you may experience with digital banking, we may ask you to clear your cache and cookies. Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

Clearing cache and cookies

- Open Chrome on your computer

- If you’re using Windows, click the More button “

” at the top right of the browser, then “More tools”

” at the top right of the browser, then “More tools”

- On a Mac, click “Chrome” from the menu bar at the top of your browser

- Click “Clear Browsing Data”

- Select “All time”

- Check the boxes next to “Cookies and other site data” and “Cached images and files”

- Click “Clear Data”

Safari (Mac)

Clearing cache

- Open Safari on your computer

- Use shortcut Command+Shift+E OR

- Click “Safari” in the browser menu bar, then “Preferences”

- Click “Advanced” and check the box next to “Show Develop menu in menu bar”

- Click “Develop” from menu bar, then “Empty cache”

Clearing cookies

- Click “Safari” in the browser menu bar

- Click “Preferences” then “Privacy”

- Click “Manage Website Data”

- Click “Remove All”

Firefox

Clearing cache and cookies

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “Preferences”

- Click “Privacy and Security”

- Click “Clear Data”

- Check the boxes next to “Cookies and Site Data” and “Cached Web Content”

- Click “Clear”

Accessing digital banking on a computer

Accessing digital banking on a computerTo provide you with a secure and protected online banking environment, we recommend using the supported browsers listed below. We do not support beta or test versions of browsers.

-

Apple Safari (latest version)

-

Google Chrome (latest version)

-

Mozilla Firefox (latest version)

-

Microsoft Edge (latest version)

-

Microsoft Internet Explorer 11

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

To access online banking through your mobile browser, simple visit https://banking.coastcapitalsavings.com.

TLS stands for Transport Layer Security (TLS). This technology allows users to establish sessions with Internet sites that are secure, meaning they have minimal risk of external violation. Once inside the Coast Online Banking site, you are secure through our use of SSL technology. Encryption is the process of scrambling information into a more secure format for transmission. This means that plain text is converted (encrypted) to a scrambled code while transmitting, and then changed back (decrypted) to plain text at the receiving end of the transmission.

Cookies

Coast Online Banking uses two kinds of cookies - session cookies and persistent cookies. We use a session cookie to maintain the integrity of your Internet banking session, and we use persistent cookies in optional enhanced features such as the saved Member Cards and saved member transfers features. For more information on our use of cookies, please review the cookies section in our Privacy Policy.

To use our app efficiently, your phone needs to meet the following requirements:

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

- Downloading the App

Your digital security is our priority. Our digital banking has several features that help keep your information and accounts safe:

-

One-time security codes. We send them via text message to your mobile phone or through an email when you complete specific tasks.

-

Device management. In the event you lose your phone or tablet, you can protect yourself and your information by disabling mobile access from a desktop computer.

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password. -

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password.

-

Proactive fraud detection. We’ve enabled sophisticated fraud detection technology that assesses real-time risk based on a number of indicators related to your information and the device you’re using to log in.

Common Questions

Yes. Our Contact Centre will use your PAN and PAC to verify your identity when you call. They are also required to use Coast-by-Phone®.

Please call us at 1.888.517.7000 and we can help recover it for you.

It’s a 7 or 8 digit security code that we’ll send you through a text message to your mobile phone or through email when you do the following:

-

Add a new bill vendor

-

Update contact information

-

Add an e-Transfer recipient

-

Change your password

If our system detects unusual activity, like logging in from a new device or location, you might be asked to enter a security code when you sign in. From time-to-time, this might also happen while paying a bill or transferring funds.

To provide you with a secure and protected online banking environment, we recommend using the supported browsers listed below. We do not support beta or test versions of browsers.

-

Apple Safari (latest version)

-

Google Chrome (latest version)

-

Mozilla Firefox (latest version)

-

Microsoft Edge (latest version)

-

Microsoft Internet Explorer 11

-

Apple Safari on iOS 9 or later

-

Google Chrome on Android 5 or later

To access online banking through your mobile browser, simply visit https://banking.coastcapitalsavings.com.

TLS stands for Transport Layer Security (TLS). This technology allows users to establish sessions with Internet sites that are secure, meaning they have minimal risk of external violation. Once inside the Coast Online Banking site, you are secure through our use of SSL technology. Encryption is the process of scrambling information into a more secure format for transmission. This means that plain text is converted (encrypted) to a scrambled code while transmitting, and then changed back (decrypted) to plain text at the receiving end of the transmission.

Cookies

Coast Online Banking uses two kinds of cookies - session cookies and persistent cookies. We use a session cookie to maintain the integrity of your Internet banking session, and we use persistent cookies in optional enhanced features such as the saved Member Cards and saved member transfers features. For more information on our use of cookies, please review the cookies section in our Privacy Policy.

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

We’re currently in the process of migrating our members over to our new digital banking platform. When it’s time for you to migrate, you’ll receive a notification when you sign in to digital banking through a computer, or you’ll be prompted to download our new app.

Received your notification? Check out our Getting Started page for instructions on how to set up your new login credentials.

To help solve challenges you may experience with digital banking, we may ask you to clear your cache and cookies. Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

Clearing cache and cookies

- Open Chrome on your computer

- If you’re using Windows, click the More button “

” at the top right of the browser, then “More tools”

” at the top right of the browser, then “More tools”

- On a Mac, click “Chrome” from the menu bar at the top of your browser

- Click “Clear Browsing Data”

- Select “All time”

- Check the boxes next to “Cookies and other site data” and “Cached images and files”

- Click “Clear Data”

Safari (Mac)

Clearing cache

- Open Safari on your computer

- Use shortcut Command+Shift+E OR

- Click “Safari” in the browser menu bar, then “Preferences”

- Click “Advanced” and check the box next to “Show Develop menu in menu bar”

- Click “Develop” from menu bar, then “Empty cache”

Clearing cookies

- Click “Safari” in the browser menu bar

- Click “Preferences” then “Privacy”

- Click “Manage Website Data”

- Click “Remove All”

Firefox

Clearing cache and cookies

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “Preferences”

- Click “Privacy and Security”

- Click “Clear Data”

- Check the boxes next to “Cookies and Site Data” and “Cached Web Content”

- Click “Clear”

Accessing digital banking on a computer

Accessing digital banking on a computerTo provide you with a secure and protected online banking environment, we recommend using the supported browsers listed below. We do not support beta or test versions of browsers.

-

Apple Safari (latest version)

-

Google Chrome (latest version)

-

Mozilla Firefox (latest version)

-

Microsoft Edge (latest version)

-

Microsoft Internet Explorer 11

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

To access online banking through your mobile browser, simple visit https://banking.coastcapitalsavings.com.

TLS stands for Transport Layer Security (TLS). This technology allows users to establish sessions with Internet sites that are secure, meaning they have minimal risk of external violation. Once inside the Coast Online Banking site, you are secure through our use of SSL technology. Encryption is the process of scrambling information into a more secure format for transmission. This means that plain text is converted (encrypted) to a scrambled code while transmitting, and then changed back (decrypted) to plain text at the receiving end of the transmission.

Cookies

Coast Online Banking uses two kinds of cookies - session cookies and persistent cookies. We use a session cookie to maintain the integrity of your Internet banking session, and we use persistent cookies in optional enhanced features such as the saved Member Cards and saved member transfers features. For more information on our use of cookies, please review the cookies section in our Privacy Policy.

To use our app efficiently, your phone needs to meet the following requirements:

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

- Downloading the App

Your digital security is our priority. Our digital banking has several features that help keep your information and accounts safe:

-

One-time security codes. We send them via text message to your mobile phone or through an email when you complete specific tasks.

-

Device management. In the event you lose your phone or tablet, you can protect yourself and your information by disabling mobile access from a desktop computer.

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password. -

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password.

-

Proactive fraud detection. We’ve enabled sophisticated fraud detection technology that assesses real-time risk based on a number of indicators related to your information and the device you’re using to log in.

Pay Bills

Tutorials

You only need to do this once per vendor. After that, you can make your payments quickly and easily.

-

Log in to digital banking

-

From the menu, click Bill Payments and select Manage Payees

-

Click the + symbol if you’re using our app, or the Add Payee button if you’re on Coast Online® Banking

-

Search for the vendor name and enter your account number

-

Confirm your selection

If you pay the same amount to the same vendor on the same date each month, consider setting up a recurring bill payment and let us do the rest.

-

Log in to digital banking

-

From the menu, click Bill Payments and select Pay Bills

-

Click the Schedule Recurring Payments tab and set the vendor, amount and frequency of the payment

You can schedule bill payments up to one year in advance.

-

Log in to digital banking

-

From the menu, click Bill Payments and select Pay Bills

-

Specify the vendor and amount you with to pay

-

Change the payment date and click Confirm

You can review and edit your scheduled payments by clicking on View Upcoming Payments from the menu.

If your transaction hasn’t been processed yet and you made an error, you can cancel your bill payment from within digital banking.

-

Log in to digital banking

-

From the menu, click Bill Payments and then View Upcoming Payments

-

Find the payment you wish to cancel and click on the trash icon next to it

-

Confirm the cancellation

If your payment does not appear on the “View Upcoming Payments” screen, your payment may have been processed already. Please contact us and be aware a cancellation service fee may apply.

To help solve challenges you may experience with digital banking, we may ask you to access digital banking using a private browser (also known as Incognito). Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

- Open Chrome on your computer

- Click the More button “

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac)

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac) - Click “New Incognito Window”

- A new window will open for you to use

Safari (Mac)

- Open Safari on your computer

- Click “File”

- Click “New Private Window”

- A new window will open for you to use

Firefox

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “New Private Window”

- A new window will open for you to use

To help solve challenges you may experience with digital banking, we may ask you to clear your cache and cookies. Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

Clearing cache and cookies

- Open Chrome on your computer

- If you’re using Windows, click the More button “

” at the top right of the browser, then “More tools”

” at the top right of the browser, then “More tools”

- On a Mac, click “Chrome” from the menu bar at the top of your browser

- Click “Clear Browsing Data”

- Select “All time”

- Check the boxes next to “Cookies and other site data” and “Cached images and files”

- Click “Clear Data”

Safari (Mac)

Clearing cache

- Open Safari on your computer

- Use shortcut Command+Shift+E OR

- Click “Safari” in the browser menu bar, then “Preferences”

- Click “Advanced” and check the box next to “Show Develop menu in menu bar”

- Click “Develop” from menu bar, then “Empty cache”

Clearing cookies

- Click “Safari” in the browser menu bar

- Click “Preferences” then “Privacy”

- Click “Manage Website Data”

- Click “Remove All”

Firefox

Clearing cache and cookies

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “Preferences”

- Click “Privacy and Security”

- Click “Clear Data”

- Check the boxes next to “Cookies and Site Data” and “Cached Web Content”

- Click “Clear”

Accessing digital banking on a computer

Accessing digital banking on a computerTo provide you with a secure and protected online banking environment, we recommend using the supported browsers listed below. We do not support beta or test versions of browsers.

-

Apple Safari (latest version)

-

Google Chrome (latest version)

-

Mozilla Firefox (latest version)

-

Microsoft Edge (latest version)

-

Microsoft Internet Explorer 11

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

To access online banking through your mobile browser, simple visit https://banking.coastcapitalsavings.com.

TLS stands for Transport Layer Security (TLS). This technology allows users to establish sessions with Internet sites that are secure, meaning they have minimal risk of external violation. Once inside the Coast Online Banking site, you are secure through our use of SSL technology. Encryption is the process of scrambling information into a more secure format for transmission. This means that plain text is converted (encrypted) to a scrambled code while transmitting, and then changed back (decrypted) to plain text at the receiving end of the transmission.

Cookies

Coast Online Banking uses two kinds of cookies - session cookies and persistent cookies. We use a session cookie to maintain the integrity of your Internet banking session, and we use persistent cookies in optional enhanced features such as the saved Member Cards and saved member transfers features. For more information on our use of cookies, please review the cookies section in our Privacy Policy.

To use our app efficiently, your phone needs to meet the following requirements:

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

- Downloading the App

Your digital security is our priority. Our digital banking has several features that help keep your information and accounts safe:

-

One-time security codes. We send them via text message to your mobile phone or through an email when you complete specific tasks.

-

Device management. In the event you lose your phone or tablet, you can protect yourself and your information by disabling mobile access from a desktop computer.

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password. -

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password.

-

Proactive fraud detection. We’ve enabled sophisticated fraud detection technology that assesses real-time risk based on a number of indicators related to your information and the device you’re using to log in.

Common Questions

You can pay up to five bills in one transaction.

-

On Coast Online® Banking, you can simply enter additional payments on the same screen.

-

On the mobile app, when you’re done entering the payment information for the first bill you wish to pay, scroll down and click the Pay Another Bill button.

If you’re outside of BC, please pay your bills through desktop banking or by accessing banking.coastcapitalsavings.com from your mobile phone. And rest assured, we’re working on a fix so you’ll be able to pay your bills through our app soon!

Sure can! Here’s how to do it:

-

Log in to online banking

-

From the menu, click Bill Payments and then Manage Payees

-

Add your city as a payee (ex. Surrey Property Tax) and register your account number

If you’re applying for a Home Owner Grant, please note we no longer forward applications. Please refer to your Property Tax Notice for details on how you can apply for the grant.

It’s a 7 or 8 digit security code that we’ll send you through a text message to your mobile phone or through email when you do the following:

-

Add a new bill vendor

-

Update contact information

-

Add an e-Transfer recipient

-

Change your password

If our system detects unusual activity, like logging in from a new device or location, you might be asked to enter a one-time security code when you log in. From time-to-time, this might also happen while paying a bill or transferring funds.

To provide you with a secure and protected online banking environment, we recommend using the supported browsers listed below. We do not support beta or test versions of browsers.

-

Apple Safari (latest version)

-

Google Chrome (latest version)

-

Mozilla Firefox (latest version)

-

Microsoft Edge (latest version)

-

Microsoft Internet Explorer 11

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

To access online banking through your mobile browser, simple visit https://banking.coastcapitalsavings.com.

TLS stands for Transport Layer Security (TLS). This technology allows users to establish sessions with Internet sites that are secure, meaning they have minimal risk of external violation. Once inside the Coast Online Banking site, you are secure through our use of SSL technology. Encryption is the process of scrambling information into a more secure format for transmission. This means that plain text is converted (encrypted) to a scrambled code while transmitting, and then changed back (decrypted) to plain text at the receiving end of the transmission.

Cookies

Coast Online Banking uses two kinds of cookies - session cookies and persistent cookies. We use a session cookie to maintain the integrity of your Internet banking session, and we use persistent cookies in optional enhanced features such as the saved Member Cards and saved member transfers features. For more information on our use of cookies, please review the cookies section in our Privacy Policy.

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

To help solve challenges you may experience with digital banking, we may ask you to access digital banking using a private browser (also known as Incognito). Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

- Open Chrome on your computer

- Click the More button “

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac)

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac) - Click “New Incognito Window”

- A new window will open for you to use

Safari (Mac)

- Open Safari on your computer

- Click “File”

- Click “New Private Window”

- A new window will open for you to use

Firefox

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “New Private Window”

- A new window will open for you to use

To help solve challenges you may experience with digital banking, we may ask you to clear your cache and cookies. Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

Clearing cache and cookies

- Open Chrome on your computer

- If you’re using Windows, click the More button “

” at the top right of the browser, then “More tools”

” at the top right of the browser, then “More tools”

- On a Mac, click “Chrome” from the menu bar at the top of your browser

- Click “Clear Browsing Data”

- Select “All time”

- Check the boxes next to “Cookies and other site data” and “Cached images and files”

- Click “Clear Data”

Safari (Mac)

Clearing cache

- Open Safari on your computer

- Use shortcut Command+Shift+E OR

- Click “Safari” in the browser menu bar, then “Preferences”

- Click “Advanced” and check the box next to “Show Develop menu in menu bar”

- Click “Develop” from menu bar, then “Empty cache”

Clearing cookies

- Click “Safari” in the browser menu bar

- Click “Preferences” then “Privacy”

- Click “Manage Website Data”

- Click “Remove All”

Firefox

Clearing cache and cookies

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “Preferences”

- Click “Privacy and Security”

- Click “Clear Data”

- Check the boxes next to “Cookies and Site Data” and “Cached Web Content”

- Click “Clear”

Accessing digital banking on a computer

Accessing digital banking on a computerTo provide you with a secure and protected online banking environment, we recommend using the supported browsers listed below. We do not support beta or test versions of browsers.

-

Apple Safari (latest version)

-

Google Chrome (latest version)

-

Mozilla Firefox (latest version)

-

Microsoft Edge (latest version)

-

Microsoft Internet Explorer 11

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

To access online banking through your mobile browser, simple visit https://banking.coastcapitalsavings.com.

TLS stands for Transport Layer Security (TLS). This technology allows users to establish sessions with Internet sites that are secure, meaning they have minimal risk of external violation. Once inside the Coast Online Banking site, you are secure through our use of SSL technology. Encryption is the process of scrambling information into a more secure format for transmission. This means that plain text is converted (encrypted) to a scrambled code while transmitting, and then changed back (decrypted) to plain text at the receiving end of the transmission.

Cookies

Coast Online Banking uses two kinds of cookies - session cookies and persistent cookies. We use a session cookie to maintain the integrity of your Internet banking session, and we use persistent cookies in optional enhanced features such as the saved Member Cards and saved member transfers features. For more information on our use of cookies, please review the cookies section in our Privacy Policy.

To use our app efficiently, your phone needs to meet the following requirements:

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

- Downloading the App

Your digital security is our priority. Our digital banking has several features that help keep your information and accounts safe:

-

One-time security codes. We send them via text message to your mobile phone or through an email when you complete specific tasks.

-

Device management. In the event you lose your phone or tablet, you can protect yourself and your information by disabling mobile access from a desktop computer.

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password. -

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password.

-

Proactive fraud detection. We’ve enabled sophisticated fraud detection technology that assesses real-time risk based on a number of indicators related to your information and the device you’re using to log in.

Paying Business Taxes

Tutorials

-

Log in to digital banking through a computer

-

From the menu, click Bill Payments, then Pay Business Taxes

-

Scroll to Payroll and Source Deductions box and click Add Account

-

Add your business number ,

select the membership(s) you would like to add it to then click Add Account

select the membership(s) you would like to add it to then click Add Account -

Click back in to Pay Business Taxes, locate the Account you’d like to pay and click on the file icon

-

Fill in the information required and click Continue and follow the rest of the prompts on screen

You pay Provincial Sales Tax (PST) like a regular bill payment. Set up a new bill payment vendor and search for “BC PROV SALES TAX”. Use your PST account number when registering the bill payment vendor.

Check out the Bill Payments topic for more information.

-

Log in to digital banking through a computer

-

From the menu, click Bill Payments, then Pay Business Taxes

-

To pay Goods and Services Tax (GST) scroll to either GST/HST 34 Filing and Remittance, GST/HST

-

Amount Owing Remittance (RC 159) or GST/HST Interim Payments Remittance (RC 160) depending on your tax payment requirement

-

Click Add Account, add the business number and select the membership(s) you would like to pay it from

-

Click back in to Pay Business Taxes, locate the Account you’d like to pay and click on the file icon

-

Fill in the information required, click Continue and follow the rest of the prompts on screen.

-

Log in to digital banking through a computer

-

From the menu, click Bill Payments, then Pay Business Taxes

-

To pay Corporation Tax scroll to Corporation Tax (RC 159/RC 160)

-

Click Add Account, add the business number and select the membership(s) you would like to add it to

-

Click back in to Pay Business Taxes, locate the Account you’d like to pay and click on the file icon

-

Fill in the information required and click Continue and follow the rest of the prompts on screen.

If your transaction hasn’t been processed yet and you made an error, you can cancel your bill payment from within digital banking.

-

Log in to digital banking

-

From the menu, click Bill Payments and then View Upcoming Payments

-

Find the payment you wish to cancel and click on the trash icon next to it

-

Confirm the cancellation

If your payment does not appear on the “View Upcoming Payments” screen, your payment may have been processed already. Please contact us and be aware a cancellation service fee may apply.

To help solve challenges you may experience with digital banking, we may ask you to access digital banking using a private browser (also known as Incognito). Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

- Open Chrome on your computer

- Click the More button “

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac)

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac) - Click “New Incognito Window”

- A new window will open for you to use

Safari (Mac)

- Open Safari on your computer

- Click “File”

- Click “New Private Window”

- A new window will open for you to use

Firefox

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “New Private Window”

- A new window will open for you to use

To help solve challenges you may experience with digital banking, we may ask you to clear your cache and cookies. Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

Clearing cache and cookies

- Open Chrome on your computer

- If you’re using Windows, click the More button “

” at the top right of the browser, then “More tools”

” at the top right of the browser, then “More tools”

- On a Mac, click “Chrome” from the menu bar at the top of your browser

- Click “Clear Browsing Data”

- Select “All time”

- Check the boxes next to “Cookies and other site data” and “Cached images and files”

- Click “Clear Data”

Safari (Mac)

Clearing cache

- Open Safari on your computer

- Use shortcut Command+Shift+E OR

- Click “Safari” in the browser menu bar, then “Preferences”

- Click “Advanced” and check the box next to “Show Develop menu in menu bar”

- Click “Develop” from menu bar, then “Empty cache”

Clearing cookies

- Click “Safari” in the browser menu bar

- Click “Preferences” then “Privacy”

- Click “Manage Website Data”

- Click “Remove All”

Firefox

Clearing cache and cookies

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “Preferences”

- Click “Privacy and Security”

- Click “Clear Data”

- Check the boxes next to “Cookies and Site Data” and “Cached Web Content”

- Click “Clear”

Accessing digital banking on a computer

Accessing digital banking on a computerTo provide you with a secure and protected online banking environment, we recommend using the supported browsers listed below. We do not support beta or test versions of browsers.

-

Apple Safari (latest version)

-

Google Chrome (latest version)

-

Mozilla Firefox (latest version)

-

Microsoft Edge (latest version)

-

Microsoft Internet Explorer 11

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

To access online banking through your mobile browser, simple visit https://banking.coastcapitalsavings.com.

TLS stands for Transport Layer Security (TLS). This technology allows users to establish sessions with Internet sites that are secure, meaning they have minimal risk of external violation. Once inside the Coast Online Banking site, you are secure through our use of SSL technology. Encryption is the process of scrambling information into a more secure format for transmission. This means that plain text is converted (encrypted) to a scrambled code while transmitting, and then changed back (decrypted) to plain text at the receiving end of the transmission.

Cookies

Coast Online Banking uses two kinds of cookies - session cookies and persistent cookies. We use a session cookie to maintain the integrity of your Internet banking session, and we use persistent cookies in optional enhanced features such as the saved Member Cards and saved member transfers features. For more information on our use of cookies, please review the cookies section in our Privacy Policy.

To use our app efficiently, your phone needs to meet the following requirements:

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

- Downloading the App

Your digital security is our priority. Our digital banking has several features that help keep your information and accounts safe:

-

One-time security codes. We send them via text message to your mobile phone or through an email when you complete specific tasks.

-

Device management. In the event you lose your phone or tablet, you can protect yourself and your information by disabling mobile access from a desktop computer.

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password. -

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password.

-

Proactive fraud detection. We’ve enabled sophisticated fraud detection technology that assesses real-time risk based on a number of indicators related to your information and the device you’re using to log in.

Common Questions

You are able to pay Payroll and Source Deductions, Provincial Sales Tax (PST), Goods and Services Tax (GST) and Corporation Taxes. Check out the above tutorials for instructions on how to do it.

Yes, when setting up your delegate you are able to give them access to pay your business taxes.

While the funds will exist your account immediately, it can take up to 3 business days for the transactions to be processed and received.

When making a payment for your business taxes, you will need to specify the payment type and it needs to match the type of remittance voucher that you were provided by CRA. They are as follows:

-

RC158 - Payment on filing (Use when sending a payment along with a return. Form RC158 will show the tax year-end)

-

RC519 - Amount owing (For the amount owing on an existing debt or to make an advance deposit for an anticipated reassessment)

-

RC160 - Interim Payments (For interim payments for a tax year-end that CRA has not yet processed a return)

Make sure you read the instructions on screen carefully, Keep receipts and confirmation of payment, and remember that they can take up to three business days to be applied to your CRA account. You can view your CRA bill payment history by clicking on Pay Bills > Pay Business Taxes, then the clock icon next to the Account you wish to review.

Taxes are categorized under specific codes. The code will be listed on your tax payment stub. Use the list below to reference your code.

-

RC (at position 10)-Corporate Tax

-

RP (at position 10)-Payroll Source Deductions

-

NR (at position 1)-Non Resident Tax

-

RT (at position 10)-Rev Can GST/ HST

-

T (at position 1)-Trust Account Tax

-

HA (at position 1)-Rev Can T5 Late Penalty Tax

-

B (at position 1)-Rev Can Citizenship and Immigration

-

RZ -Information Returns, Amount Owing -Corporate Tax

Your digital security is our priority. Our digital banking has several features that help keep your information and accounts safe:

-

One-time security codes. We send them via text message to your mobile phone or through an email when you complete specific tasks.

-

Device management. In the event you lose your phone or tablet, you can protect yourself and your information by disabling mobile access from a desktop computer.

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password. -

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password.

-

Proactive fraud detection. We’ve enabled sophisticated fraud detection technology that assesses real-time risk based on a number of indicators related to your information and the device you’re using to log in.

Interac e-Transfers®

Tutorials

To send someone an e-Transfer, they need to be on your list of recipients.

-

Sign in to digital banking

-

From the menu, click Interac e-Transfers® then Manage Recipients. Follow the instructions for providing a security code

-

Enter the recipient’s name, email address and/or mobile phone number and set a security question that only you and the recipient know the answer to

-

Log in to digital banking

-

From the menu, click Interac e-Transfers then Send e-Transfer

The first time you access this, you will be prompted to create a profile registering your email and/or mobile phone number. This is how others will send you e-Transfers in the future.

-

Select the recipient and specify whether you want to send the notification through email, mobile phone or both

-

Select which account you wish to transfer from and specify the amount of the transfer

-

Click Send Transfer

The amount will be debited from your account immediately, plus a $1.50 service fee. The recipient will get a notification within about 30 minutes inviting them to accept the e-transfer. They will need to answer the security question you set up for them.

When someone sends you an e-Transfer, you will get a notification through email or text message.

-

Check the link provided to ensure it is encrypted (look for https: instead of http: in the link URL)

-

Click on the link to access a secure Interac website

-

Select British Columbia from the Credit Union drop down menu, then select Coast Capital

-

You will be redirected to Coast Capital’s digital banking login screen or mobile app. Once there, log into digital banking.

-

Answer the security question and select which account you wish to make your deposit

Does a customer owe your for services rendered? Send them an e-Transfer Funds Request to request payment.

-

Log in to digital banking through a computer or your mobile app

-

From the menu, click e-Transfers then Request e-Transfers

-

Fill in the Request e-Transfer fields and click Request

-

Confirm the details and click Continue

Things to know

-

There is a $1.50 service fee per request sent

-

The recipient of the request will receive a notification within 30 minutes of you sending the request

Tired of typing in answers every time you receive an e-Transfer? Set up auto-deposit to have e-Transfers automatically deposited into the account of your choice.

-

Log in to digital banking

-

From the menu, click Interac e-Transfers, then Auto-Deposit

-

Enter your email address and specify the account where deposits will be made

-

Check the boxes to acknowledge the statements and click Register

-

You will receive an email from Interac with steps to complete Auto-Deposit registration

To help solve challenges you may experience with digital banking, we may ask you to access digital banking using a private browser (also known as Incognito). Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

- Open Chrome on your computer

- Click the More button “

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac)

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac) - Click “New Incognito Window”

- A new window will open for you to use

Safari (Mac)

- Open Safari on your computer

- Click “File”

- Click “New Private Window”

- A new window will open for you to use

Firefox

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “New Private Window”

- A new window will open for you to use

To help solve challenges you may experience with digital banking, we may ask you to clear your cache and cookies. Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

Clearing cache and cookies

- Open Chrome on your computer

- If you’re using Windows, click the More button “

” at the top right of the browser, then “More tools”

” at the top right of the browser, then “More tools”

- On a Mac, click “Chrome” from the menu bar at the top of your browser

- Click “Clear Browsing Data”

- Select “All time”

- Check the boxes next to “Cookies and other site data” and “Cached images and files”

- Click “Clear Data”

Safari (Mac)

Clearing cache

- Open Safari on your computer

- Use shortcut Command+Shift+E OR

- Click “Safari” in the browser menu bar, then “Preferences”

- Click “Advanced” and check the box next to “Show Develop menu in menu bar”

- Click “Develop” from menu bar, then “Empty cache”

Clearing cookies

- Click “Safari” in the browser menu bar

- Click “Preferences” then “Privacy”

- Click “Manage Website Data”

- Click “Remove All”

Firefox

Clearing cache and cookies

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “Preferences”

- Click “Privacy and Security”

- Click “Clear Data”

- Check the boxes next to “Cookies and Site Data” and “Cached Web Content”

- Click “Clear”

Accessing digital banking on a computer

Accessing digital banking on a computerTo provide you with a secure and protected online banking environment, we recommend using the supported browsers listed below. We do not support beta or test versions of browsers.

-

Apple Safari (latest version)

-

Google Chrome (latest version)

-

Mozilla Firefox (latest version)

-

Microsoft Edge (latest version)

-

Microsoft Internet Explorer 11

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

To access online banking through your mobile browser, simple visit https://banking.coastcapitalsavings.com.

TLS stands for Transport Layer Security (TLS). This technology allows users to establish sessions with Internet sites that are secure, meaning they have minimal risk of external violation. Once inside the Coast Online Banking site, you are secure through our use of SSL technology. Encryption is the process of scrambling information into a more secure format for transmission. This means that plain text is converted (encrypted) to a scrambled code while transmitting, and then changed back (decrypted) to plain text at the receiving end of the transmission.

Cookies

Coast Online Banking uses two kinds of cookies - session cookies and persistent cookies. We use a session cookie to maintain the integrity of your Internet banking session, and we use persistent cookies in optional enhanced features such as the saved Member Cards and saved member transfers features. For more information on our use of cookies, please review the cookies section in our Privacy Policy.

To use our app efficiently, your phone needs to meet the following requirements:

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

- Downloading the App

Your digital security is our priority. Our digital banking has several features that help keep your information and accounts safe:

-

One-time security codes. We send them via text message to your mobile phone or through an email when you complete specific tasks.

-

Device management. In the event you lose your phone or tablet, you can protect yourself and your information by disabling mobile access from a desktop computer.

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password. -

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password.

-

Proactive fraud detection. We’ve enabled sophisticated fraud detection technology that assesses real-time risk based on a number of indicators related to your information and the device you’re using to log in.

Common Questions

-

An Interac e-Transfer® is a quick and secure way to transfer funds to and from your Coast Capital membership.

-

All you need is the recipient’s mobile phone number or email address.

-

There is no service fee to receive an e-Transfer. A service fee may apply to send one.

If a recipient has not yet accepted the transfer, you can cancel it.

-

Log in to digital banking

-

From the menu, click Interac e-Transfers then Pending e-Transfers

-

Click the trash icon beside the e-Transfer you wish to cancel

Confirm you want to cancel the e-Transfer

There is no fee to receive an e-Transfer. A service fee may apply to send one.

It can take up to 30 minutes for the recipient to receive a notification.

You can resend the notification.

-

Log in to digital banking

-

From the menu, click Interac e-Transfers then Pending e-Transfers

-

Click Resend Notice beside the e-Transfer

-

Cancel the e-Transfer

-

Update the recipient’s details. Access this by clicking on Interac e-Transfers® from the menu, then Manage Recipients. You may be prompted to enter a security code. After that, simply edit the recipient’s information.

-

Resend the e-Transfer

- Log in to digital banking through a computer or our mobile app

- From the menu, tap Business Services, then Review Pending Transactions

- Select eTransfer and Business Tax Payments

- Find the pending transaction, review it and tap Approve or Reject

Sending funds

-

Send up to $3,000 per transaction

-

Send up to $3,000 every 24 hours

-

Send up to $10,000 every 7 days

-

Send up to $20,000 every 30 days

Receiving funds

-

Receive up to $10,000 per transaction

-

Receive up to $10,000 every 24 hours

-

Receive up to $70,000 every 7 days

-

Receive up to $300,000 every 30 days

You can view the last 24 months of your sent e-Transfer history in digital banking.

-

Sign in to digital banking

-

From the menu, select e-Transfers then View e-Transfer History

-

Make your Date selections and select Continue

-

You can search for up to 365 days per search

-

-

On the results page, you can select Details to view more information about the e-Transfer

Some received e-Transfers will have additional details if the sending financial institution supports this feature. These details could include additional payee/payor information, or additional invoice or document notes. At this time, it is not possible to include these details in e-Transfers sent from Coast Capital.

If the sending financial institution supports the sending of e-Transfers in real-time and you have the Auto-Deposit feature enabled, you will receive your deposit immediately. The Auto-Deposit feature allows you to receive e-Transfers without needing to provide a security answer.

If the sending financial institution supports account-to-account e-Transfers, the sender may also send a real-time e-Transfer using your account, institution, and transit number. Contact the person sending the e-Transfer to confirm if their institution supports this feature.At this time, it is not possible to send an e-Transfer from Coast Capital using an account number. However, we do support Auto-Deposit. If the recipient has Auto-Deposit enabled, they should receive your e-Transfer in close to real-time.

Transfers

Common Questions

On Desktop

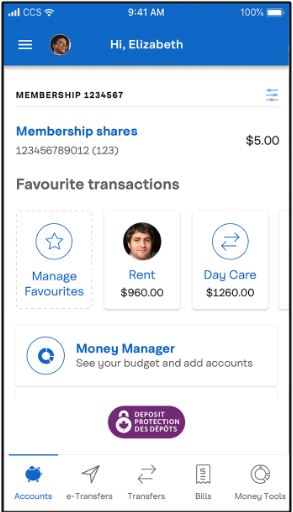

You’ll be prompted with a pop-up message during your regular login process which will guide you through setting up a new username and password.

On Mobile

When logging into the mobile banking app the pop-up message will instruct you to download the new Coast Capital Digital Banking App. The new app will have a white background with a blue logo.

Afterwards, you’ll be guided through setting up a new username and password.

Need more guidance? Check out our tutorial.

Yes, you can grant one of two permissions for each delegate on each business: read-only or initiator.

No, delegates cannot authorize transactions on a two to sign business membership. They can initiate transactions, but not authorize or complete them.

You, or another business signer, will create a username for the delegate when adding them to the membership. After this, a temporary password will be auto-generated for the delegate to access the new online banking experience. Once they log in for the first time, they’ll be prompted to create their own password.

The signer, or signers, on the business account, haven’t completed the setup process for the new digital banking experience. Once they finish getting set up, they can add you back as a delegate.

If you used the Consolidate Memberships feature in our old online banking, when you migrate over to the enhanced digital banking experience, you’ll need to set this up again.

It’s easy to do:

- Ensure you’ve migrated all memberships over to the new digital banking experience.

Scroll to the right of the page and you should see different actions available to you, such as Add Account, Remit, History, etc. We’re in the middle of figuring out why on certain browsers that scroll is required. Thank you for your patience while we make it more optimized for your viewing.

This is an intermittent event that some members are experiencing and we’re working on a fix. In the meantime, you can access e-Transfers through our mobile app. If you prefer using digital banking on desktop, try accessing it through an incognito browser. If you are still having issues, try again later

Please round up to the nearest round number. CRA does not accept decimal values.

When making a payment for your Business taxes, you will need to specify the payment type and it needs to match the type of remittance voucher that you were provided by CRA.

They are as follows:

RC158 - Payment on filing

Use when sending a payment along with a return. Form RC158 will show the tax year-end.

RC519 - Amount owing

For the amount owing on an existing debt or to make an advance deposit for an anticipated reassessment.

RC160 - Interim Payments

For interim payments for a tax year-end that CRA has not yet processed a return.

Tutorials

To transfer money between accounts in your own membership:

-

Log in to digital banking

-

From the menu, click Transfers then Transfer Funds

-

Select the account to make the transfer from and where it will transfer to

-

Specify the amount and click Continue

On this screen you also have the option to schedule a transfer in the future, or set a recurring transfer, which is a great way to build your savings account.

-

Log in to digital banking

-

From the menu, click Transfers then Transfer Funds

-

Select the account you wish to transfer funds from

-

Select Transfer to another member and enter their membership number

-

Specify the amount and click Continue

Saving is easy when you “set it and forget it”. You can do that by setting a recurring transfer from one account to a savings account. This works great if your payroll is automatically deposited into your chequing account on a regular basis, and you set the transfer date based on when your payroll is deposited.

-

Log in to digital banking

-

From the menu, click Transfers then Transfer Funds

-

Select the account to make the transfer from and where it will transfer to

-

Under Schedule transfer, change the selection to Recurring transfer

-

Specify the amount, start date, frequency and end date

-

Click Continue

Interac e-Transfers are a safe and secure way to send funds outside of Coast Capital. Learn how.

If your transaction hasn’t been processed yet and you made an error, you can cancel your bill payment from within digital banking.

-

Log in to digital banking

-

From the menu, click Bill Payments and then View Upcoming Payments

-

Find the payment you wish to cancel and click on the trash icon next to it

-

Confirm the cancellation

If your payment does not appear on the “View Upcoming Payments” screen, your payment may have been processed already. Please contact us and be aware a cancellation service fee may apply.

To help solve challenges you may experience with digital banking, we may ask you to access digital banking using a private browser (also known as Incognito). Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

- Open Chrome on your computer

- Click the More button “

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac)

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac) - Click “New Incognito Window”

- A new window will open for you to use

Safari (Mac)

- Open Safari on your computer

- Click “File”

- Click “New Private Window”

- A new window will open for you to use

Firefox

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “New Private Window”

- A new window will open for you to use

To help solve challenges you may experience with digital banking, we may ask you to clear your cache and cookies. Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

Clearing cache and cookies

- Open Chrome on your computer

- If you’re using Windows, click the More button “

” at the top right of the browser, then “More tools”

” at the top right of the browser, then “More tools”

- On a Mac, click “Chrome” from the menu bar at the top of your browser

- Click “Clear Browsing Data”

- Select “All time”

- Check the boxes next to “Cookies and other site data” and “Cached images and files”

- Click “Clear Data”

Safari (Mac)

Clearing cache

- Open Safari on your computer

- Use shortcut Command+Shift+E OR

- Click “Safari” in the browser menu bar, then “Preferences”

- Click “Advanced” and check the box next to “Show Develop menu in menu bar”

- Click “Develop” from menu bar, then “Empty cache”

Clearing cookies

- Click “Safari” in the browser menu bar

- Click “Preferences” then “Privacy”

- Click “Manage Website Data”

- Click “Remove All”

Firefox

Clearing cache and cookies

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “Preferences”

- Click “Privacy and Security”

- Click “Clear Data”

- Check the boxes next to “Cookies and Site Data” and “Cached Web Content”

- Click “Clear”

Accessing digital banking on a computer

Accessing digital banking on a computerTo provide you with a secure and protected online banking environment, we recommend using the supported browsers listed below. We do not support beta or test versions of browsers.

-

Apple Safari (latest version)

-

Google Chrome (latest version)

-

Mozilla Firefox (latest version)

-

Microsoft Edge (latest version)

-

Microsoft Internet Explorer 11

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

To access online banking through your mobile browser, simple visit https://banking.coastcapitalsavings.com.

TLS stands for Transport Layer Security (TLS). This technology allows users to establish sessions with Internet sites that are secure, meaning they have minimal risk of external violation. Once inside the Coast Online Banking site, you are secure through our use of SSL technology. Encryption is the process of scrambling information into a more secure format for transmission. This means that plain text is converted (encrypted) to a scrambled code while transmitting, and then changed back (decrypted) to plain text at the receiving end of the transmission.

Cookies

Coast Online Banking uses two kinds of cookies - session cookies and persistent cookies. We use a session cookie to maintain the integrity of your Internet banking session, and we use persistent cookies in optional enhanced features such as the saved Member Cards and saved member transfers features. For more information on our use of cookies, please review the cookies section in our Privacy Policy.

To use our app efficiently, your phone needs to meet the following requirements:

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

- Downloading the App

Your digital security is our priority. Our digital banking has several features that help keep your information and accounts safe:

-

One-time security codes. We send them via text message to your mobile phone or through an email when you complete specific tasks.

-

Device management. In the event you lose your phone or tablet, you can protect yourself and your information by disabling mobile access from a desktop computer.

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password. -

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password.

-

Proactive fraud detection. We’ve enabled sophisticated fraud detection technology that assesses real-time risk based on a number of indicators related to your information and the device you’re using to log in.

Common Questions

You can transfer to and from your own USD chequing accounts just like a CAD funds transfer. Unfortunately, you are unable to transfer USD outside of your membership at this time.

If you have a recurring or scheduled transfer you would like to cancel, follow these steps.

-

Log in to digital banking

-

From the menu, click Transfers then View Upcoming Transfers

-

Click the trash icon next to the transfer you wish to cancel

-

$25,000 per transaction

- $50,000 every 24 hours

To transfer between your consolidated accounts you will need to make an inter-member transfer between your memberships. Follow the tutorial above named “Transfer to another Coast Capital Member” to learn how.

To help solve challenges you may experience with digital banking, we may ask you to access digital banking using a private browser (also known as Incognito). Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

- Open Chrome on your computer

- Click the More button “

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac)

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac) - Click “New Incognito Window”

- A new window will open for you to use

Safari (Mac)

- Open Safari on your computer

- Click “File”

- Click “New Private Window”

- A new window will open for you to use

Firefox

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “New Private Window”

- A new window will open for you to use

To help solve challenges you may experience with digital banking, we may ask you to clear your cache and cookies. Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

Clearing cache and cookies

- Open Chrome on your computer

- If you’re using Windows, click the More button “

” at the top right of the browser, then “More tools”

” at the top right of the browser, then “More tools”

- On a Mac, click “Chrome” from the menu bar at the top of your browser

- Click “Clear Browsing Data”

- Select “All time”

- Check the boxes next to “Cookies and other site data” and “Cached images and files”

- Click “Clear Data”

Safari (Mac)

Clearing cache

- Open Safari on your computer

- Use shortcut Command+Shift+E OR

- Click “Safari” in the browser menu bar, then “Preferences”

- Click “Advanced” and check the box next to “Show Develop menu in menu bar”

- Click “Develop” from menu bar, then “Empty cache”

Clearing cookies

- Click “Safari” in the browser menu bar

- Click “Preferences” then “Privacy”

- Click “Manage Website Data”

- Click “Remove All”

Firefox

Clearing cache and cookies

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “Preferences”

- Click “Privacy and Security”

- Click “Clear Data”

- Check the boxes next to “Cookies and Site Data” and “Cached Web Content”

- Click “Clear”

Accessing digital banking on a computer

Accessing digital banking on a computerTo provide you with a secure and protected online banking environment, we recommend using the supported browsers listed below. We do not support beta or test versions of browsers.

-

Apple Safari (latest version)

-

Google Chrome (latest version)

-

Mozilla Firefox (latest version)

-

Microsoft Edge (latest version)

-

Microsoft Internet Explorer 11

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

To access online banking through your mobile browser, simple visit https://banking.coastcapitalsavings.com.

TLS stands for Transport Layer Security (TLS). This technology allows users to establish sessions with Internet sites that are secure, meaning they have minimal risk of external violation. Once inside the Coast Online Banking site, you are secure through our use of SSL technology. Encryption is the process of scrambling information into a more secure format for transmission. This means that plain text is converted (encrypted) to a scrambled code while transmitting, and then changed back (decrypted) to plain text at the receiving end of the transmission.

Cookies

Coast Online Banking uses two kinds of cookies - session cookies and persistent cookies. We use a session cookie to maintain the integrity of your Internet banking session, and we use persistent cookies in optional enhanced features such as the saved Member Cards and saved member transfers features. For more information on our use of cookies, please review the cookies section in our Privacy Policy.

To use our app efficiently, your phone needs to meet the following requirements:

-

Apple Safari on iOS 10 or later

-

Google Chrome on Android 4.4 or later

- Downloading the App

Your digital security is our priority. Our digital banking has several features that help keep your information and accounts safe:

-

One-time security codes. We send them via text message to your mobile phone or through an email when you complete specific tasks.

-

Device management. In the event you lose your phone or tablet, you can protect yourself and your information by disabling mobile access from a desktop computer.

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password. -

Security alerts. To protect you and your information, we’ll send you a security email and text message when rare or suspicious activity takes place, like if your account is locked due to a failed password.

-

Proactive fraud detection. We’ve enabled sophisticated fraud detection technology that assesses real-time risk based on a number of indicators related to your information and the device you’re using to log in.

Deposit On-the-go

General Solutions

You’ll be able to manage employee access, review and approve pending transactions and consolidate all your memberships under one login.

Our functionality with some 3rd party aggregators has been temporarily impacted due to recent security enhancements. We are aware of these issues and are working with our partners to ensure that functionality is returned to normal

If you used the Consolidate Memberships feature in our old online banking, when you migrate over to the enhanced digital banking experience, you’ll need to set this up again.

It’s easy to do:

- Ensure you’ve migrated all memberships over to the new digital banking experience.

To transfer between your own memberships (whether or not they are consolidated), perform your transfer as if you were transferring to another member.

-

Log in to digital banking to the membership you wish to transfer from

-

From the menu, click Transfers then Transfer Funds

-

Select the account to transfer from

-

Select Transfer to another member and enter the membership number of your membership you want to transfer to

-

Specify the amount and click Continue

Tutorials

-

Log in to digital banking through our mobile app

-

From the menu, tap Deposit On-the-go

-

Specify which account you’d like to deposit your cheque in to and enter the amount of the cheque

-

Tap Take Photo and follow the instructions on the screen

-

Tap Confirm to deposit the cheque

Things you should know

Sign the back of your cheque before you photograph it

Keep the cheque for 90 days, then destroy it within the next 30 days

Holds may apply when you deposit cheques through Deposit On-the-go or an ATM. If you’re unsure what your hold policy is, contact us.

You may be subject to mobile charges. Please consult your phone provider for more details.

-

Log in to digital banking

-

From the menu, click Interac e-Transfers then Send e-Transfer

The first time you access this, you will be prompted to create a profile registering your email and/or mobile phone number. This is how others will send you e-Transfers in the future.

-

Select the recipient and specify whether you want to send the notification through email, mobile phone or both

-

Select which account you wish to transfer from and specify the amount of the transfer

-

Click Send Transfer

The amount will be debited from your account immediately, plus a $1.50 service fee. The recipient will get a notification within about 30 minutes inviting them to accept the e-transfer. They will need to answer the security question you set up for them.

When someone sends you an e-Transfer, you will get a notification through email or text message.

-

Check the link provided to ensure it is encrypted (look for https: instead of http: in the link URL)

-

Click on the link to access a secure Interac website

-

Select British Columbia from the Credit Union drop down menu, then select

-

Coast Capital to be redirected to Coast Capital’s digital banking login screen or mobile app

-

Log in to digital banking

-

Answer the security question and select which account you wish to make your deposit

Tired of typing in answers every time you receive an e-Transfer? Set up auto-deposit to have e-Transfers automatically deposited into the account of your choice.

-

Log in to digital banking

-

From the menu, click Interac e-Transfers, then Auto-Deposit

-

Enter your email address and specify the account where deposits will be made

-

Check the boxes to acknowledge the statements and click Register

-

You will receive an email from Interac with steps to complete Auto-Deposit registration

If your transaction hasn’t been processed yet and you made an error, you can cancel your bill payment from within digital banking.

-

Log in to digital banking

-

From the menu, click Bill Payments and then View Upcoming Payments

-

Find the payment you wish to cancel and click on the trash icon next to it

-

Confirm the cancellation

If your payment does not appear on the “View Upcoming Payments” screen, your payment may have been processed already. Please contact us and be aware a cancellation service fee may apply.

To help solve challenges you may experience with digital banking, we may ask you to access digital banking using a private browser (also known as Incognito). Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

- Open Chrome on your computer

- Click the More button “

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac)

” at the top right of the browser (Windows) or “File” from the menu bar at the top of your browser (Mac) - Click “New Incognito Window”

- A new window will open for you to use

Safari (Mac)

- Open Safari on your computer

- Click “File”

- Click “New Private Window”

- A new window will open for you to use

Firefox

- Open Firefox on your computer

- Click the Menu button “

” on the right of your browser bar

” on the right of your browser bar - Click “New Private Window”

- A new window will open for you to use

To help solve challenges you may experience with digital banking, we may ask you to clear your cache and cookies. Here’s how to do it on a few popular browsers: Chrome, Safari and Firefox. If you use a different browser, a quick Google search should help you.

Chrome (Windows and Mac)

Clearing cache and cookies

- Open Chrome on your computer

- If you’re using Windows, click the More button “