Surrey, BC – Although nearly three-quarters of B.C. parents are stressed about the cost of post-secondary, nine out of ten who believe their children will attend higher education are already saving or have a plan to do so, according to a new poll by Leger for Coast Capital Savings.

The Leger online survey of 600 B.C caregivers who have a child going to school this fall was conducted between July 18 and 24, 2019. The survey found:

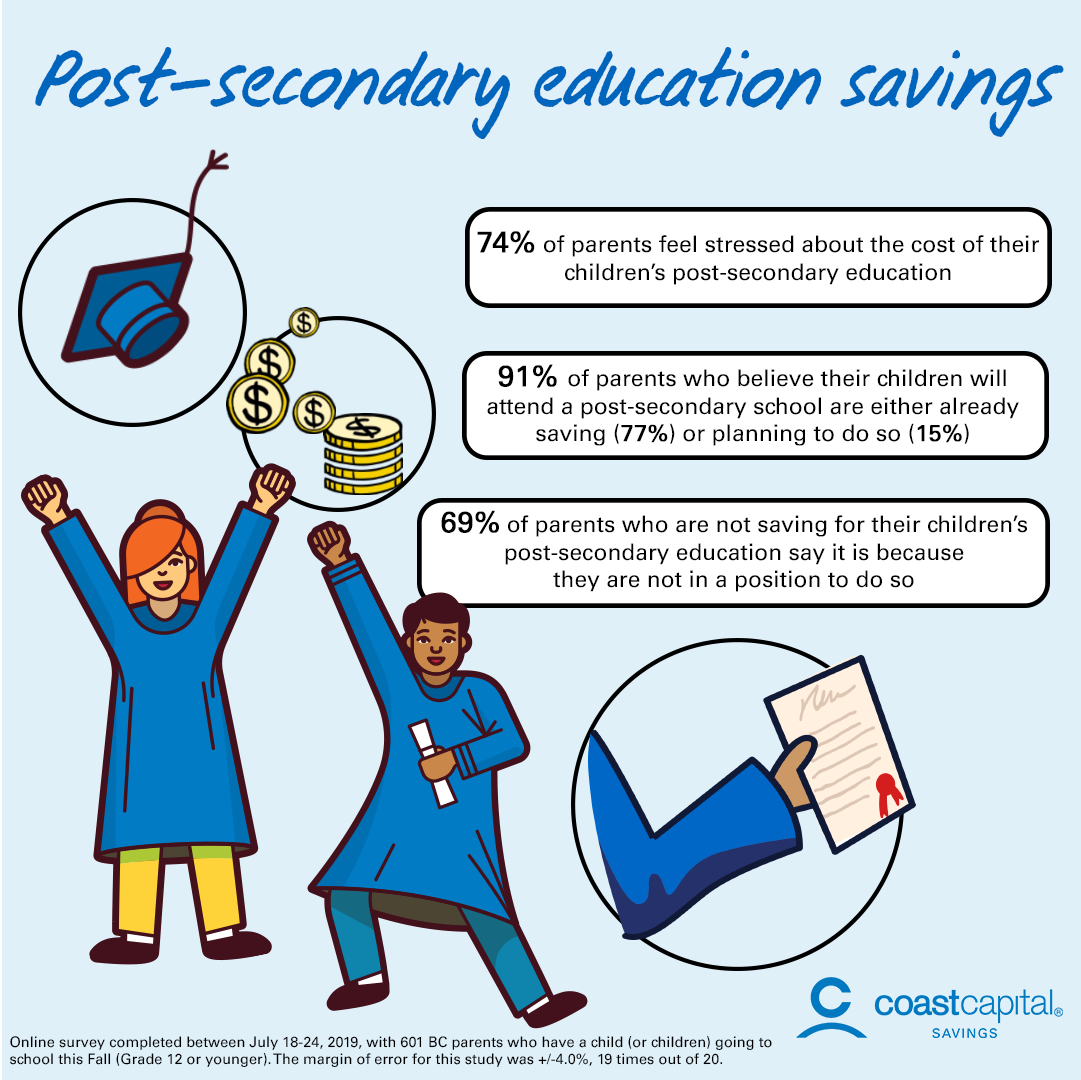

- 74 per cent of parents feel stressed about the cost of their children’s post-secondary education

- 91 per cent of parents who believe their children will attend a post-secondary school are either already saving (77 per cent) or planning to do so (15 per cent)

- Of the 22 per cent of parents who are not saving for their children’s post-secondary education, 69 per cent say it is because they are not in a position to do so

“We know that parents want the best for their kids, including a good education. It’s encouraging that even though parents are stressed by the cost, most are planning ahead to invest in their children’s post-secondary education, whether that be college, university, trade school, or apprenticeship programs,” says Tracey Arnish, Chief Member Experience Officer, Coast Capital Savings.

The Leger survey found that a third of parents had not heard of the B.C Training and Education Savings Grant, through which the provincial government contributes $1,200 to an RESP for children between the ages of six and nine.

“It’s concerning that of the parents who are not saving, nearly seven-in-ten either can’t save, or believe they can’t. The good news is, there are simple steps that parents and guardians can take to save for their children’s’ education, including applying for the B.C. government RESP grant when your child turns six,” explains Arnish. “The federal government will also add money to an RESP, so even a few dollars a week can make a real difference over time.”

While the study also found that 63 per cent of parents expect that saving for post-secondary will be a family affair, with children and other family members also contributing to the costs, this approach is not available to all youth. Coast Capital co-founded the Youth Futures Education Fund to provide financial support for youth formerly in government care who are attending post-secondary education.

Note: The results of the Leger survey are from an online survey of 600 parents who have a child going to school this fall, and were conducted between July 18-24, 2019. The margin of error for this study was +/-4.0%, 19 times out of 20.

About Coast Capital Savings

Coast Capital Savings is Canada’s largest credit union by membership and B.C.’s first credit union to become a federal credit union. Owned by its 572,000 members, Coast Capital offers banking and investment services digitally and through its 52 branches in the Metro Vancouver, Fraser Valley, Okanagan, and Vancouver Island regions of British Columbia. An Imagine Canada Caring Company and a Certified B Corporation in recognition of its social performance, Coast Capital invests 10 per cent of its bottom line in youth-focused community organizations, programs, partnerships and events. The credit union has been recognized as one of Canada's Most Admired Corporate Cultures™, and holds a Best Managed Companies Platinum Club designation. Coast Capital has a history of introducing innovative products to help their members achieve financial wellbeing including Canada’s first free chequing account from a full-service financial institution and Help Extras®, enabling members to invest in their future. To learn more, visit coastcapitalsavings.com.

-30-

Coast Capital Media Line:

Phone number: 778.391.6225

Email address: media@coastcapitalsavings.com