A little goes a long way with a PAC

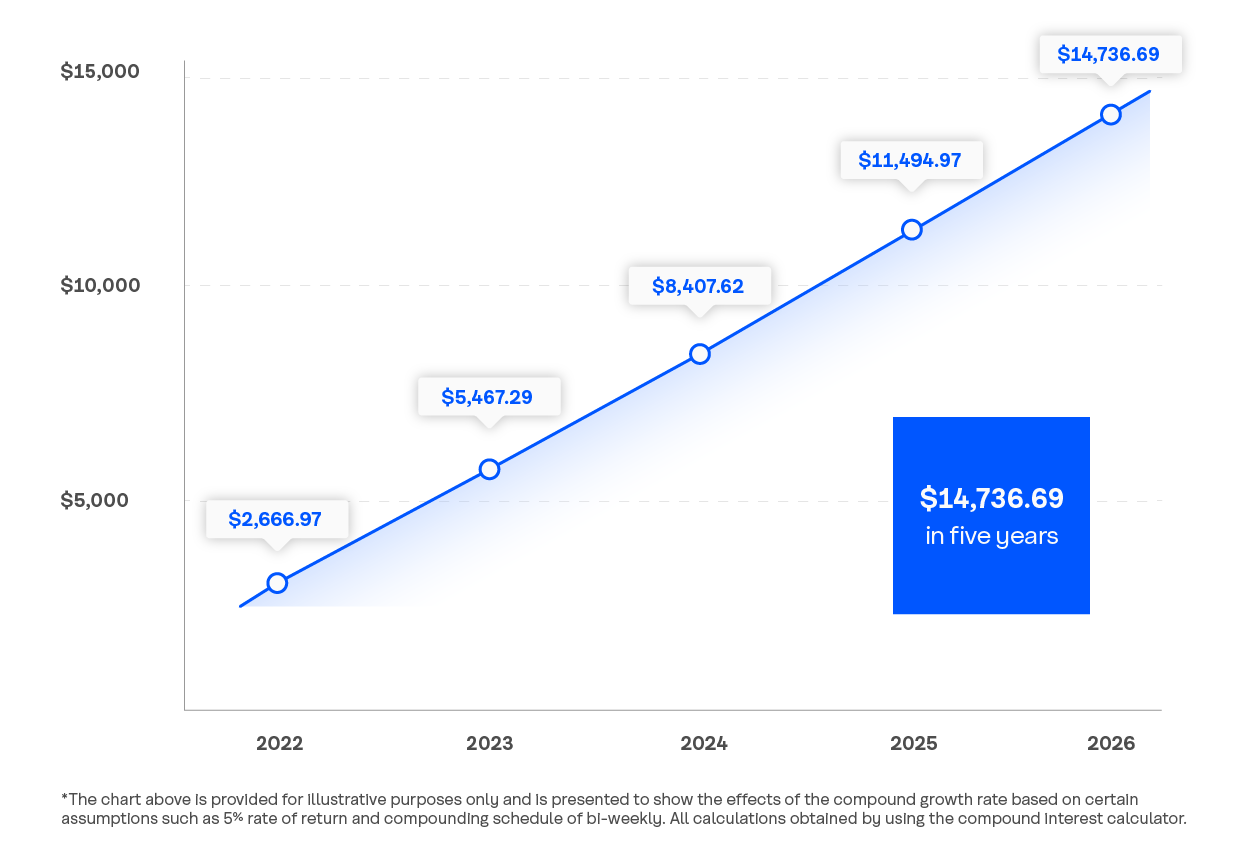

If you put away $100 every two weeks into a balanced investment at 5%, it can grow to over $14,000 in just 5 years*.

A little goes a long way with a PAC

If you put away $100 every two weeks into a balanced investment at 5%, it can grow to over $14,000 in just 5 years*.